Amid the escalation of the military conflict in Ukraine Natural gas prices have soared as the West tightens economic sanctions against Moscow.

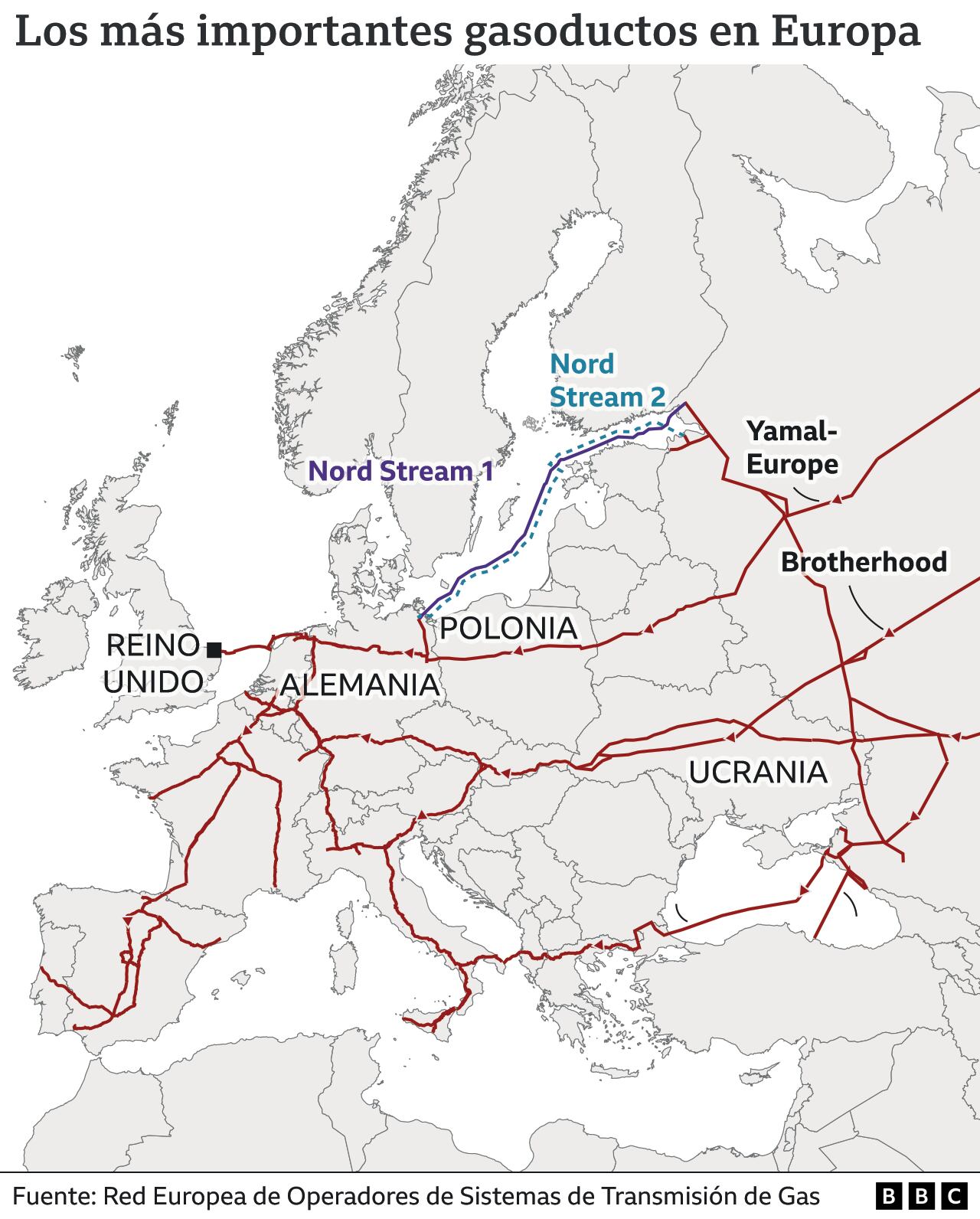

Close to 40% of the natural gas that Europe imports comes from Russia, a dependency that has increased the concern of governments in the current war scenario.

SIGHT: The reasons why the Russian convoy has “little progress” on its way to Kiev

Although Germany has suspended the final approval of the Nord Stream 2 gas pipeline that would allow it to increase gas imports from Russia, European countries continue to buy Russian gas, while intensifying financial sanctions against Moscow.

The shortage of global supplies and the gigantic wave of inflation affecting the world have left European governments against a rock and a hard place, according to experts in this area, especially to Germanywhich had made the decision to decrease its nuclear power sources.

- Israel’s dilemma in the face of the Russian invasion of Ukrainian territory

- “He has no idea what is coming”: how Biden delivered the biggest warning from a US leader to a Russian one since the end of the Cold War

- 6 key moments from the first week of Russia’s invasion of Ukraine

“Russian gas is Europe’s Achilles heel in this warthat is its great vulnerability, that is what allows Russia to capitalize and finance this adventurism that it has,” says Ángel Saz-Carranza, director of the Center for Global Economy and Geopolitics of Esade (EsadeGeo), Spain; academician of the Department of ESADE Business School Strategy and Visiting Professor at Georgetown University, United States.

Saz-Carranza, an aeronautical engineer from Imperial College of the University of London and a doctor in Management Sciences, has specialized in analysis of political risk, governance, lobby and regulation.

How much does Europe depend on Russian natural gas to supply its demand?

The dependence is too high, as we see now, around 40% of our gas in Europe depends on Russian gas.

And, on the other hand, how much does Russia depend on the European market for its gas exports?

That is what clarifies the situation a bit because Russia’s dependence on the European market is also very high. In fact, its capacity to transmit gas to the east is residual.

Excluding liquefied natural gas, which can be exported via ships, almost all of Russia’s gas pipelines come to the west.

How likely is it that the Russian government will decide to close the gas taps in response to the sanctions that Europe and the United States have imposed?

It is a real possibility given the moment we are in and given Russia’s own reaction. Russia is acting with a lack of rationality, a certain excessive missionality on the part of the president, something messianic.

Therefore we are in a somewhat unknown scenario, but in principle let’s say that Russia could turn off the taps. However, right now, with the sanctions and the economic pressure that Russia has, it is also true that the only capital inflow that it has is through the payment for that gas.

Russia could cut off gas and Europe could endure two or three months without that gas, but it is also true that Russia would lose the only source of international capital that it has right now.

How much of Russia’s tax revenue depends on gas sales to Europe?

Estimates that I have seen recently are around half of the public budget. That is a lot, but it is also true that Russia currently has a very low public debt, it has quite a few reserves.

Everything indicates that Russia had been preparing for several years so that its financial situation would allow it to face any external threat, at least for a while…

Russia has spent some time cleaning up its fiscal accounts, both reserves and debt, despite the country’s economic hardship and the suffering caused by previous sanctions.

That’s why he might have some maneuvering. But right now it is not convenient for Europe to stop buying Russian gas, we have to see how sanctions continue to be defined with SWIFT (Society for Worldwide Interbank and Financial Communications, SWIFT).

SIGHT: What is the SWIFT network and why is it considered a key weapon to pressure Russia in the conflict with Ukraine

In principle, neither Russia nor Europe should turn off the gas tap.

Which companies sell and which companies buy Russian gas?

In Russia, piped gas comes via Gazprom and liquefied natural gas, especially destined for Asia, is made by Rosnef, which is the oil company but also makes liquefied gas.

In Europe, there are large gas companies that are normally private companies, although with significant public shareholders.

So governments alone cannot stop buying gas from Russia…

The countries right now are under tremendous pressure that they already had before due to very high electricity and energy prices in Europe. In Europe, prices have tripled so far this year.

Faced with this pressure where some social discontent has already been seen, you have some political leaders who would have to decide not to buy. Surely it is already too late to react right now, so the political incentive is really the other way around, that is, the political incentive is that please do not raise prices. That is what Europe’s political leaders are thinking.

How not to raise gas prices in the short term? Well, keep buying from Russia.

We should have made a strategy not only with public incentives, but even with political direction, to guide these private companies in one direction or another.

The political price to pay now, in the midst of the crisis, could be very high. How do you see it?

There are two problems. In the short term, the politician has the incentive to continue buying gas as cheaply as possible -which is from Gazprom right now-; and, on the other hand, he has a problem in Europe: that state influence in the energy market through public companies is very controlled.

It could be seen as a rupture of the free market and free competition between companies. Surely now in a war situation it can be done, but it is not easy to do it in the long term either.

Right now the barrier for the semi-state gas companies in Europe to stop buying is that prices would skyrocket, it would block many industries and it would generate tremendous chaos at a time when we have very high inflation in Europe and we are trying to get out of the crisis of covid.

So to stop buying or reduce gas purchases from Russia is very unlikely due to the political costs that such a decision would have…

That could be done if the war continues to intensify a lot and the European population is willing to assume that cost.

Clearly we would see a doubling of the price. They have already tripled so far this year, so it would be a very tough situation, very tough, but hey, maybe that’s what it’s about.

That would have a high cost for Europe, that decision is not free. That is why the sanctions have exempted oil and gas, including the American sanctions because the American sanctions depend on the price of oil.

Sanctioning Russia would generate some very relevant domestic problems at the political level for Biden.

Without Russian gas, Europe will not go out tomorrow, but we would need to rethink many things.

What are the other sources of natural gas that Europe can turn to?

There is a part that could replace it, for example, by burning more coal, although that is not very positive for climate policies. Also with a little more own production, which is very little.

It could increase something, not much, what comes from Algeria and what comes from Norway. Of course, what he would have to do would be to try to buy the maximum amount of shipments by ship of liquefied natural gas.

Of course, there is not enough liquefied gas available without having been previously contracted in the market to supply the 40% of gas that Europe buys from Russia.

We would have to go for other types of sources and then try to increase the sources that we already have at hand, which are Norway and Algeria, and finally the alternative of liquefied natural gas.

Although liquefied natural gas has its own difficulties…

It has the difficulty that the regasification plants in Europe are not distributed in an optimal way. There are logistical problems there. So having a year of covered gas demand in Europe without Russian gas is very difficult to see.

In addition, we would enter into a price war with Asia, in which we have already been involved to a certain extent for liquefied gas and I think that demand management would have to be carried out, that is, consumption rationalized.

Europe was campaigning to move towards renewable energies, but it seems that it will be difficult to advance on that path with the current conflict. What is your opinion?

Europe has tried to diversify in the last decade with renewable energies and also with projects such as the gas pipeline that connects us with Azerbaijan via Turkey, but on the other hand, companies have moved closer to Russian gas.

So there has been a dissonance between political and business will. The incentives have not been well calibrated.

Strange things have also happened. Apart from the fact that Gazprom has played its cards and has been able to attract European companies, we have also seen that it is very difficult to make the energy transition and move away from coal or close nuclear plants and diversify from Russia. Doing all that is very difficult.

Russia has also made great alliances with the Middle East, with the Emirates, for example, and other parts of the Gulf countries.

Could it be said then that dependence on Russian gas is like the Achilles heel of Europe at the moment?

Without a doubt, Russian gas is Europe’s Achilles heel in this war, that is its great vulnerability, that is what allows Russia to capitalize and finance this adventurism that it has.

The high price of oil and gas allows Russia to live relatively well and to finance itself that way.

Do you think that a possible decision by Europe not to buy gas from Russia goes beyond economic and geopolitical considerations? I ask because there could also be an ethical dilemma, that is, to what extent does the fact that Europe continues to buy gas from Russia imply that it is indirectly helping to finance its military campaign?

Completely. Europe is financing Putin’s whims. That is something that Europe has to begin to consider, that is, it has to consider how to align its private sector. It has not done so during this decade, it has not been able to diversify enough.

The lesson here is that in the future we have to be smarter to steer the business sector towards these political goals.

________________________________

- Ukraine compares bombing of Kiev to that of Nazi Germany in 1941

- Ukraine reports the death of 2,800 Russian soldiers on the second day of the invasion

- Why did Russia invade Ukraine and what are Putin’s arguments for war?

- A shocking audio reveals how Russian soldiers threaten and then kill 13 Ukrainian soldiers on an island

- These are the countries that support Russia and those that are with Ukraine

- NATO activates its defense troops for the first time in history to deter Russia

Source: Elcomercio

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/GE4DCMJNGAZS2MBTKQYDAORRHA.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/5654RWXEZNAHBAUQGSA5AMCBPI.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/JPYS2JSCNZFVHKJMBAQ54SUD4Q.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/RPJROQVAJ5B37H63IB4CPRCTJY.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/IYDS3N674JCGPMG2OUWFIWVARY.jpg)