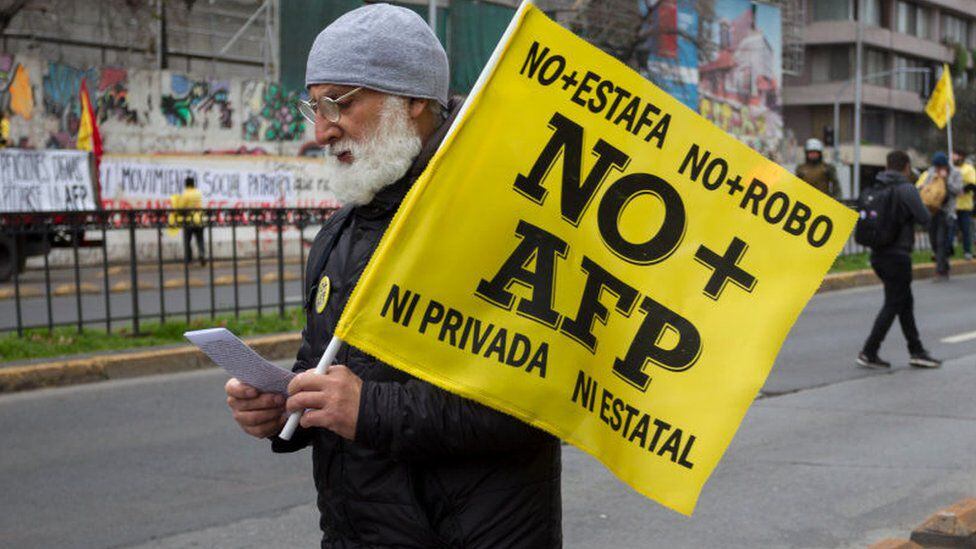

One of the main demands of the social outbreak at the end of 2019 in Chili was to end the current pension system.

And he became one of the emblematic campaign promises of the leftist president Gabriel Boricwho this Wednesday announced the sending of a bill to Congress to change the current private system of Pension Fund Administrators (AFP).

LOOK: “With lithium, Latin America is at risk of repeating the movie of extractivism of its minerals in exchange for a few coins”

“The AFPs, in this reform, are ended,” said Boric, announcing that the reform is based on social security principles with state contributions, employers and workers.

One of the most significant changes in the proposal is to contemplate the creation of a state agency, a public fund administrator, to end the exclusive management of the criticized AFP.

“There will be new private investment managers with the exclusive purpose of investing pension funds and, in addition, there will be a public alternativewhich will make it possible to promote competition with the entry of new actors,” said the president.

The original Chilean pension model, created in 1980 during the military regime of Augusto Pinochet, is based on compulsory savings by workers in an individual account managed by the AFPs and whose funds are invested in the capital market.

In 2008, during the first government of President Michelle Bachelet, a Basic Solidarity Pension was added to the system, which consists of a contribution from the State for the most vulnerable people.

According to government calculations, a person who contributed a monthly salary of about US$425 during half of his working life currently receives a pension of around US$280.

Under the new system, that person would earn about US$415, that is, 46% more in the case of men and 52% more in the case of women.

Why is it so difficult to get approved?

The financing of the reform to the pension system proposed by the government It depends on the approval of the tax reform of the president, who does not have the support of the opposition and has just begun his parliamentary discussion.

In the current Congress, the most divided since Chile returned to democracy, the governing coalition is a minority in both chambers and it has the lowest number of deputies and senators in recent decades.

On the other hand, a section of the ruling alliance has voted against several of Boric’s proposals, a sign that the initiative may not be guaranteed the full backing of the political bloc.

The defenders of the current system argue that the model has contributed to the development of the national financial market that allows financing company projects and, therefore, explains a third of the greater economic growth that Chile has experienced from 1980 onwards, according to a study of the AFP Association, the union entity that brings together private firms.

Its detractors, however, consider that the investments of the AFPs have exclusively benefited the elites and that the system only works if you have a stable job throughout your working life and a high income, something that is out of reach for the vast majority. from the workers.

This is the third attempt to reform the pension system, after the projects of the governments of Michelle Bachelet (second term) and Sebastián Piñera did not come to fruition.

During the covid-19 pandemic, opposition legislators approved early withdrawals of the individual funds of the workers managed by the AFPs, as an emergency measure to face the health crisis.

That made it for the first time in the history of the country, the Chileans made use of their individual savings before reaching old age, accessing billions of dollars that came out of the private system.

Source: Elcomercio

I, Ronald Payne, am a journalist and author who dedicated his life to telling the stories that need to be said. I have over 7 years of experience as a reporter and editor, covering everything from politics to business to crime.

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/GI4DEMRNGEYS2MBTKQYDAORSHA.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/W6U6VJS5M5GAPCUQ3OFAXRF5QI.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/332MGD7T6NCCXKGMSDO3YXX46A.jpg)