Four years and two currency reconversions later, Venezuela it comes out of the hyperinflation cycle it was in since 2017.

LOOK: “They locked me up in a military detachment and raped me for 25 nights”

The Central Bank of Venezuela (BCV), the country’s public banking institution, released inflation figures on Saturday: according to the National Consumer Price Index, the month-on-month price variation in December was 7.6%.

This means that Venezuela has fulfilled exactly twelve months with a variation below 50%, considered by experts as the threshold of hyperinflation.

And not only that, but in addition, Venezuela has already had an inflationary variation of single digits for four consecutive months. Inflation in September 2021 was 7.1%, that of October 6.8%, that of November 8.4% and that of December 7.6% according to the same data from the issuing entity.

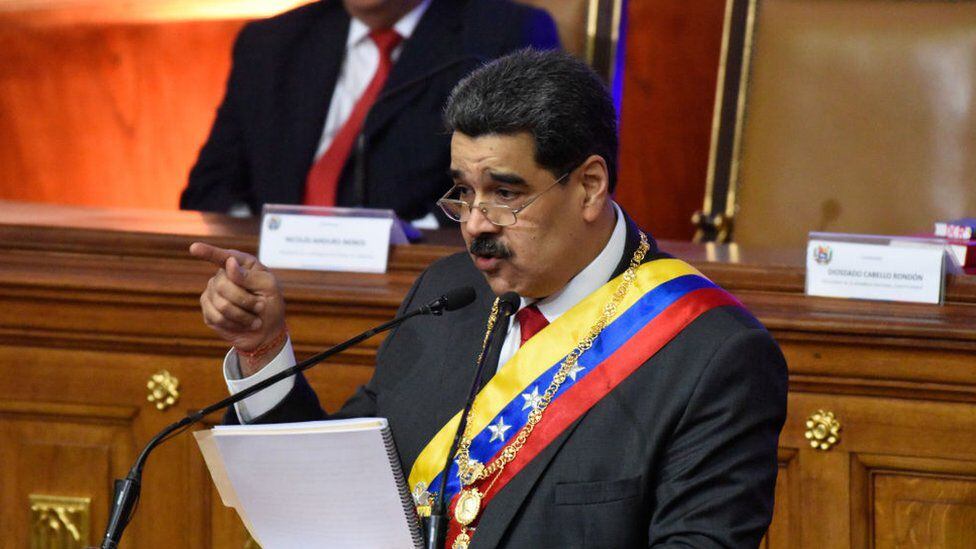

This does not come as a surprise to many people. The same national president, Nicolás Maduro, had said days ago that Venezuela had closed the cycle of hyperinflation in an interview for the Telesur channel.

“I can declare politically, with the result of the inflation management between the months of September, October, November and December, which has been one digit with a downward trend, that Venezuela is leaving the state of hyperinflation,” said the president .

But what does this mean? And what are the consequences for the Venezuelan economy, which has had to face one of the longest hyperiflationary processes in modern history?

Good and “not so good” news

For Luis Oliveros, professor and economist at the Metropolitan University, the end of the hyperinflationary cycle represents “excellent news.”

The expert highlights that Venezuela has gone through four years with variations “that exceeded 100% and even more. It was (inflation) too high,” he tells BBC Mundo.

This cycle had started in the last quarter of 2017 when a monthly inflation of 56.7% was registered, thus exceeding the threshold. That year, according to the BCV, annual inflation was 862.6%.

But that was only a preamble to what was to come. 2018, the year in which hyperinflation shot up, closed with a rate of 130.060%; and the economy between 2013, when oil prices fell, and 2018 contracted by 47.6%.

It was from the first quarter of 2019 that the rise in prices slowed down, registering variations above the 50% threshold only at specific times.

The last time that Venezuela registered a monthly variation above 50% was in December 2020, when prices increased 77.5%. Since January 2021 and until today, Venezuela has not registered monthly variations above 50 points.

Economists like Oliveros had already witnessed this trend and ensured that Venezuela would emerge from hyperinflation between the end of 2021 and the first months of 2022.

However, this is not necessarily good news for the oil nation.

And it is that the one of Venezuela, already even without the prefix of “hiper”, it still has the highest inflation in the world today. According to the same BCV, 2021 closed with an accumulated annual inflation of 686.4%.

“An average variation of 7% per month may be low for the context of Venezuela,” emphasizes Oliveros. “But it is still very high for average annual inflation in the region and the world.”

For example, Colombia’s annual inflation for 2021 was 5.62% after December registered a monthly inflation of 0.73%, according to figures from the National Administrative Department of Statistics (DANE) of that country.

Venezuela’s hyperinflation it has been one of the longest in modern history, surpassed only by Nicaragua (1986-1991) and Greece (1941-1945).

Venezuela closed 2020 with an inflation of 2,968.8%, said the BCV.

Why is this happening?

Good and “not so good” news

For Luis Oliveros, professor and economist at the Metropolitan University, the end of the hyperinflationary cycle represents “excellent news.”

The expert highlights that Venezuela has gone through four years with variations “that exceeded 100% and even more. It was (inflation) too high,” he tells BBC Mundo.

This cycle had started in the last quarter of 2017 when a monthly inflation of 56.7% was registered, thus exceeding the threshold. That year, according to the BCV, annual inflation was 862.6%.

But that was only a preamble to what was to come. 2018, the year in which hyperinflation shot up, closed with a rate of 130.060%; and the economy between 2013, when oil prices fell, and 2018 contracted by 47.6%.

It was from the first quarter of 2019 that the rise in prices slowed down, registering variations above the 50% threshold only at specific times.

The last time that Venezuela registered a monthly variation above 50% was in December 2020, when prices increased 77.5%. Since January 2021 and until today, Venezuela has not registered monthly variations above 50 points.

Economists like Oliveros had already witnessed this trend and ensured that Venezuela would emerge from hyperinflation between the end of 2021 and the first months of 2022.

However, this is not necessarily good news for the oil nation.

And it is that the one of Venezuela, already even without the prefix of “hiper”, it still has the highest inflation in the world today. According to the same BCV, 2021 closed with an accumulated annual inflation of 686.4%.

“An average variation of 7% per month may be low for the context of Venezuela,” emphasizes Oliveros. “But it is still very high for average annual inflation in the region and the world.”

For example, Colombia’s annual inflation for 2021 was 5.62% after December registered a monthly inflation of 0.73%, according to figures from the National Administrative Department of Statistics (DANE) of that country.

Venezuela’s hyperinflation it has been one of the longest in modern history, surpassed only by Nicaragua (1986-1991) and Greece (1941-1945).

Venezuela closed 2020 with an inflation of 2,968.8%, said the BCV.

Why is this happening?

This process from hyperinflation to “serious inflation” would not have been possible had it not been for a “cocktail” of decisions issued by the government central, as explained by Asdrúbal Oliveros (they have no relationship), director of the Ecoanalítica firm.

Like his colleague, Asdrubal Oliveros agrees that this change in the economy has implications that are positive but must be seen in context.

With the fall in oil prices in 2013, a contraction of the economy and the sanctions imposed by the US, Canada and the European Union, the Maduro administration applied a significant reduction in expenditures by the State, restrictions on bank credit and lower spending in bolivars to maintain exchange rate stability.

The fiscal deficit is the balance that results from subtracting its expenses from the income of a State. If the result is positive, that State has a fiscal surplus. But if the result is negative, like what was happening in Venezuela, it means that you are spending more than you are earning.

By 2017, the public deficit exceeded 20% of Gross Domestic Product (GDP), the highest in Latin America. But an independent study by the Andrés Bello Catholic University placed it at 7.9% for 2020.

Other measures applied was end the gasoline subsidy (for years the cheapest in the world, cheaper than a bottle of mineral water), loosen price control and open the foreign exchange market, which was subject to tight state control for more than 16 years. This allowed for more imports and a small revival of private industry.

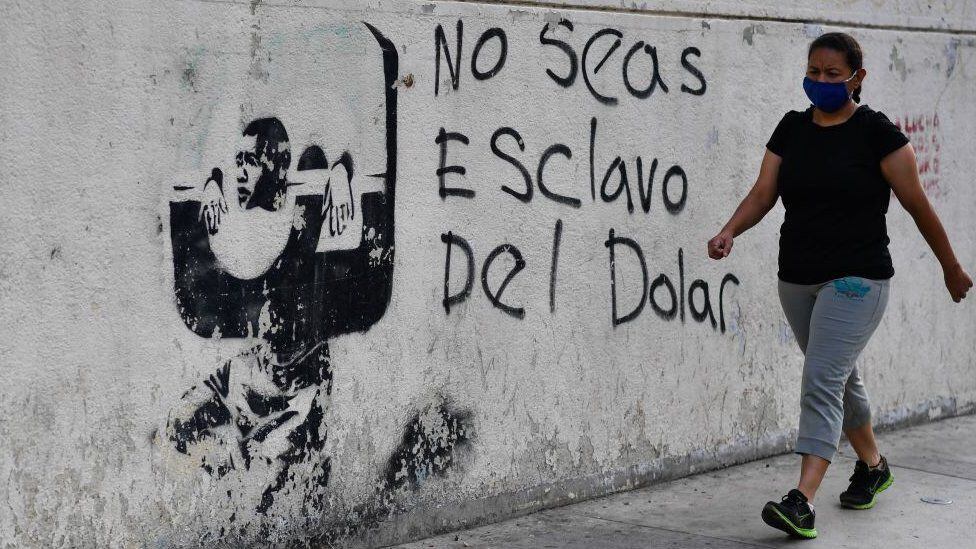

What about dollarization?

But there is a key point in everything, and that is the dollarization. For years, Venezuelans have been using the dollar as currency for more and more transactions.

This represents a balloon of oxygen for many Venezuelans who saw their income diminished in the face of the fall in value of the battered bolivar, which has undergone a total of three currency reconversions since 2008 (two since the beginning of hyperinflation) and the elimination of 14 zeros.

From Caracas, people assure that the dollar is here to stay. If the image of Venezuela in 2017 was of empty supermarkets, that of 2021 was that of dollars. And the experts consulted by BBC Mundo point out that this dynamic will continue to occur in 2022.

Still lifes, supermarkets and clothing stores now mark their prices in foreign currency and the dollar is used for almost two-thirds of transactions, according to Ecoanalítica.

This dollarization has several characteristics: the first is that it is de facto since it was not part of a formal government strategy but was assumed by the Venezuelans themselves.

The second is that the bolivar has not been replaced by the dollar, no matter how devalued it is. And that’s why analysts say that dollarization is partial, since the government keeps the national currency for, for example, paying public employees or charging for services.

“We have two Venezuelas”, assures Asdrúbal Oliveros. On the one hand, a social class that has adopted the dollar as a frequently used currency; and on the other a class that finds it difficult to access dollars and needs to adapt to get them anyway, Explain.

“So you have to see what the true impact of inflation is,” he continues. “It is added that you have an increase in the cost of living in dollars, which although it is lower (than the bolivar), is very significant.”

“Indeed, dollarization has brought inequality,” says Luis Oliveros. “In this story there are losers who now don’t have access to dollars.”

What is the government’s position and what challenges does it face?

“I am attentive to the currency sector, to defend the bolivar, wages, income with the national card. Evaluate how this process called dollarization can serve for the recovery and deployment of the country’s forces. It is a Exhaust valve. Thank God it exists. “

The phrase was said by Maduro himself in front of television cameras on November 17, 2019.

Since then, the dollar has circulated freely more and more clearly. But that does not mean that the government is embracing full dollarization of the economy.

Adopting the dollar as a currency “would be the worst mistake” for Venezuela, Vice President Delcy Rodríguez said last December. “2022 will be the year of definitive recovery of the bolivar as a national currency,” he added.

But Venezuela continues to face significant challenges, says Luis Oliveros. Not only to continue lowering inflation but to correct the exchange overvaluation.

“The government focused on the exchange rate not moving so much, and it has practically not moved in the last four months,” he says. “But if the exchange rate does not move, there is still inflation and that is when this overvaluation appears.

Overvaluation causes imports to be cheaper than production, which translates into a disincentive for the internal economy.

“The big task is economic growth. Venezuela had seven years of economic decline. But if we continue to have overvaluation, inflation will continue,” concludes Luis Oliveros.

- “You cannot vaccinate the planet every 6 months. It is not sustainable “

- America’s strategy to ride out the waves of coronavirus

- France identifies new variant of COVID-19 called IHU with 46 mutations

- The Bogdanoff brothers, the most famous twins in France, die of coronavirus six days apart

- Coronavirus: What is “flurone”, the strange picture of double infection that puts the world on alert

.

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/GE4TCMZNGAYS2MJRKQYDAORRHE.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/WYY7GA7WSNEYBPPDAWLUDSZ4CE.jpg)

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/XVBYWUZG5FGCXISHSSJNODQY6U.jpg)